Forward Performance Tracking

What this page is

This page documents forward performance tracking — a running record of how live trading behaves relative to historical expectations.

It is not a forecast, not a guarantee, and not a performance summary.

It is documentation.

Each update compares:

- demo backtests (optimistic execution assumptions)

- live-account backtests (more conservative execution assumptions)

- actual live trades

Full context and explanation are provided in the accompanying videos.

How to read these charts

Backtests and live trading behave differently.

- Demo backtests assume cleaner execution

- Live-account backtests reflect spreads, slippage, and timing

- Actual trades show what happened in reality

The goal is not for live trading to match optimistic backtests,

but to remain consistent with conservative expectations over time.

Forward Performance Tracking Log

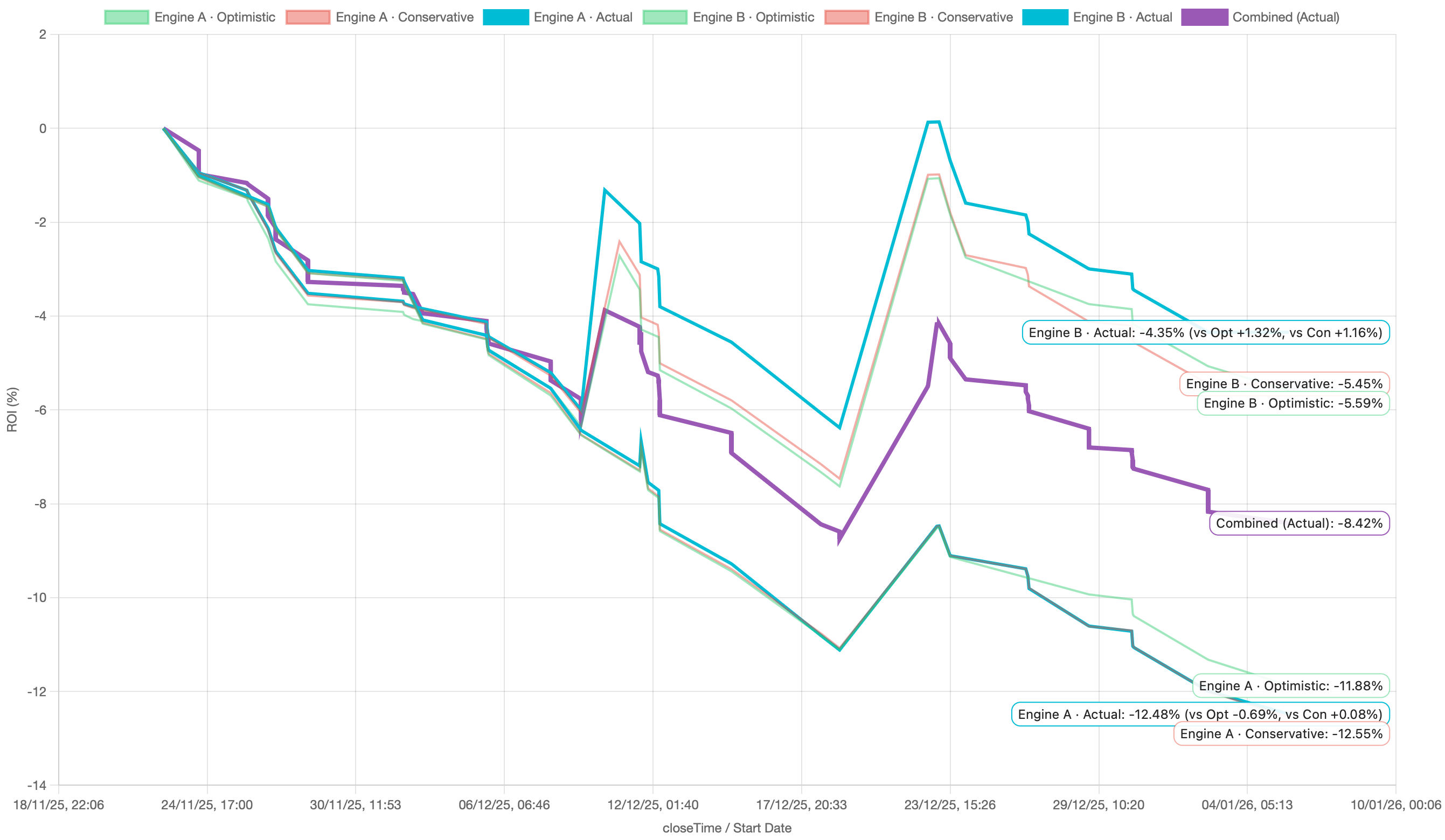

FPT #001 — Demo vs Live Backtests + Actual

Date: January 2026

This first entry establishes the baseline.

It shows:

- the difference between demo and live backtest assumptions

- how Engines A and B behave under both

- how actual trades compare since public launch

Video explanation:

👉 Forward Performance Tracking #1 — Demo vs Live Backtests Explained

Equity curve:

This chart is updated as new live data becomes available.

It represents documentation, not prediction.

Update cadence

This page is updated periodically as new Forward Performance Tracking episodes are published.

Each entry follows the same process:

- same engines

- same metrics

- same assumptions

- no changes after the fact

Relationship to the Quant Report

The Quant Report explains what was built and how it was tested.

Forward Performance Tracking documents what happens next.

If you’re looking for system design, validation, and assumptions, start there.

If you’re looking for live behavior over time, you’re in the right place.

All results shown are hypothetical backtests unless stated otherwise.

Past performance does not guarantee future results.